Trusted solutions for the UK’s financial, tax, and regulated digital reporting mandates.

The UK is one of the earliest adopters of structured digital reporting, beginning with mandatory Inline XBRL submissions to HMRC. Today, the UK also requires digital annual financial reporting through the FCA’s UKSEF regime — closely aligned with ESMA’s ESEF requirements.

Ez‑XBRL has supported UK filers from the very beginning, delivering performance, accuracy, and reliability across all UK reporting mandates.

HMRC Inline XBRL (Corporation Tax)

The HMRC CT600 requirement mandates that financial statements must be submitted in Inline XBRL. Ez‑XBRL provides:

- High‑quality PDF → Inline XBRL transformation

- UK GAAP and UK taxonomy tagging

- Agentic-AI-driven tagging recommendations

- HMRC validation and compliance checks

- Review workflows for accountants, auditors, and tax professionals

FCA / UKSEF (UK Single Electronic Format)

Companies listed on UK-regulated markets must submit their annual financial reports in:

- Inline XBRL / XHTML

- UKSEF-compliant format

- Tagged primary statements

- Block‑tagged notes

Our capabilities include:

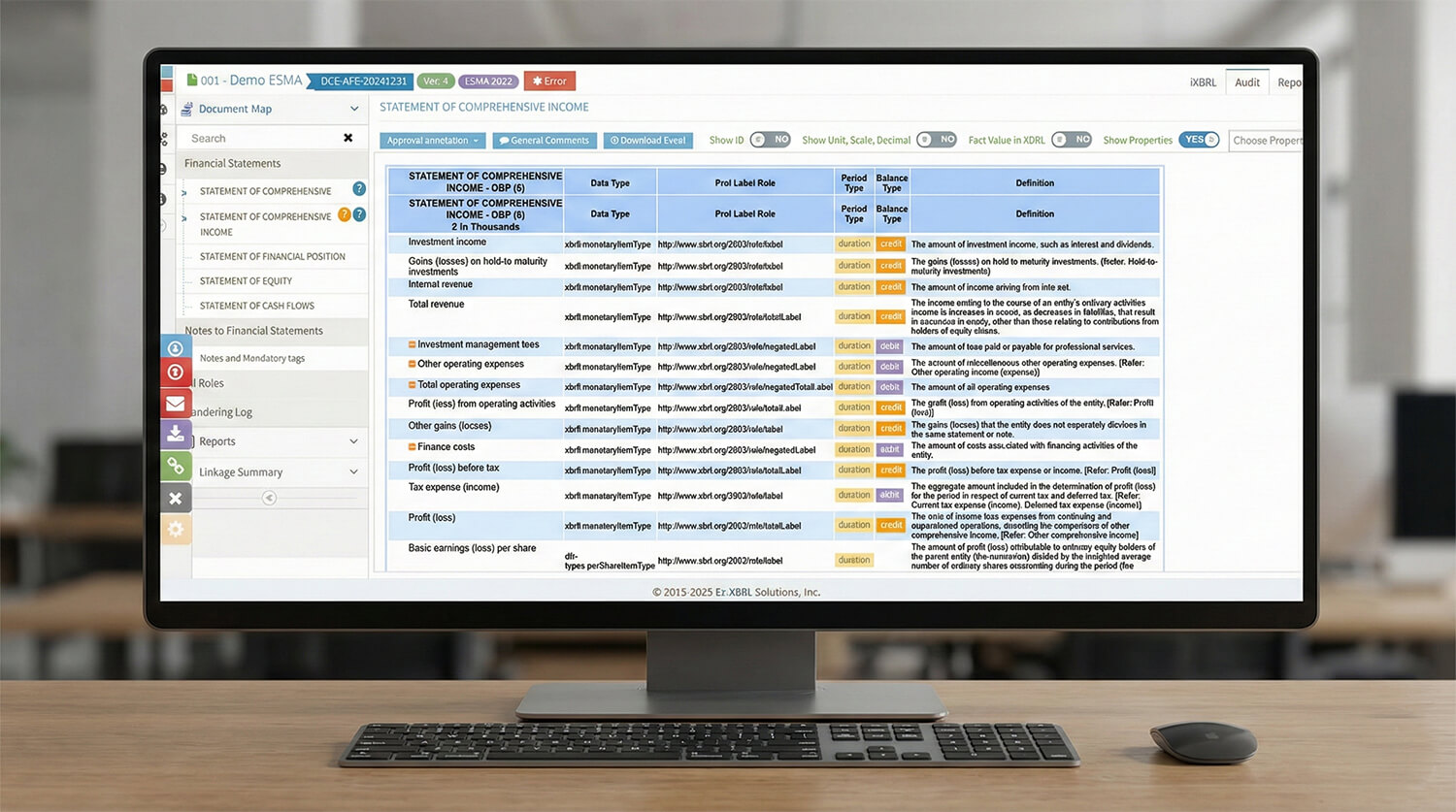

- Integix-based Inline XBRL creation

- Support for UKSEF taxonomy alignment

- Handling of both UKSEF and ESEF for dual-listed companies

- Comprehensive FCA validations

- Multilingual tagging support when required

Agentic AI for UK Filers

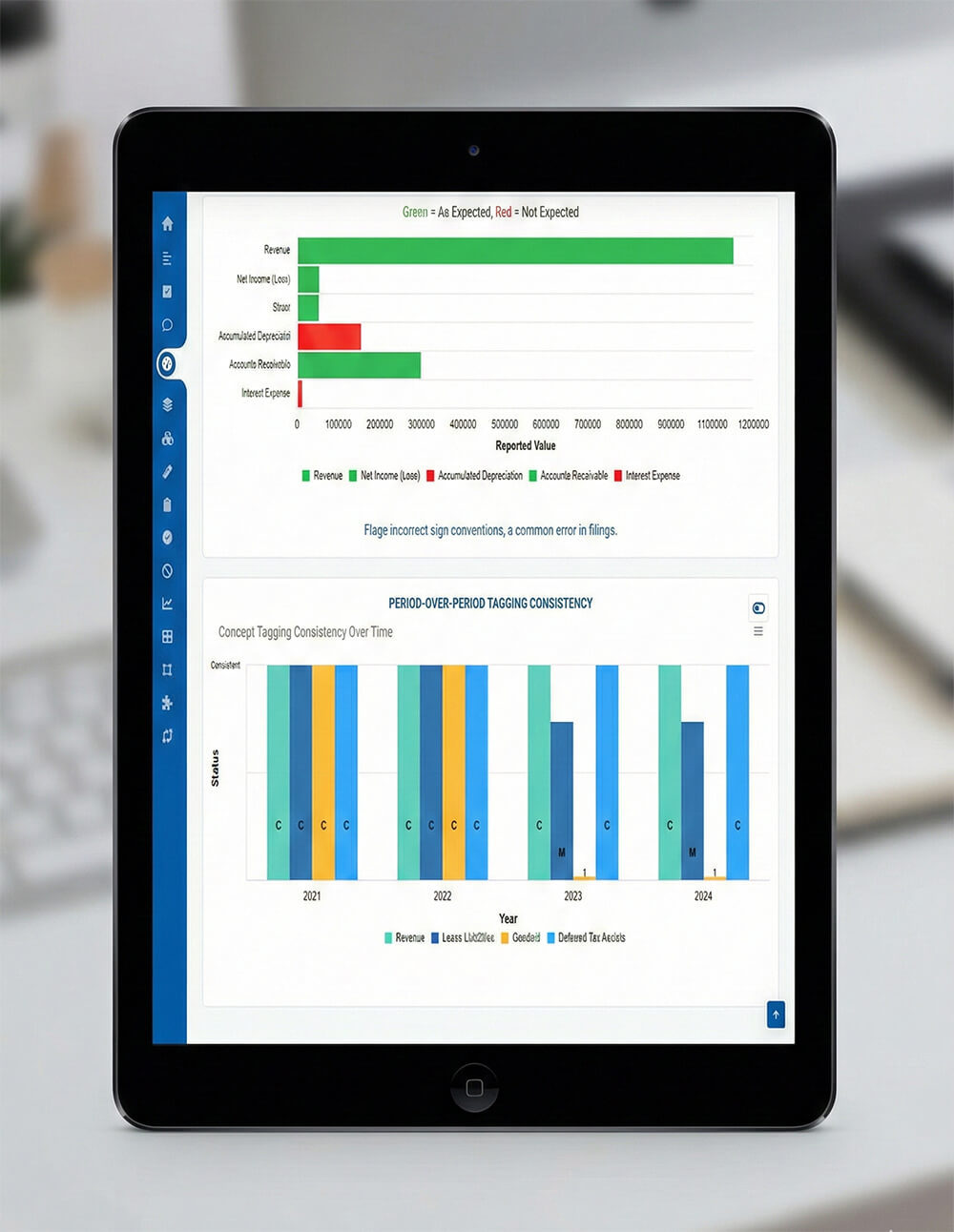

Ez-XBRL’s Agentic-AI engine reduces tagging and review time dramatically:

- Automated tag suggestions for UK-specific disclosures

- Rapid detection of tables, notes, and structures

- Block-tagging acceleration

Consistency checks across narrative and quantitative data - Integration with XOR for validation & review

Extended UK Support

- XML-based government reporting where applicable

- Sustainability reporting aligned with UK expectations

- Support for UK-headquartered groups needing compatibility with CSRD/ESRS and ESEF

Experience how Agentic AI is transforming disclosure workflows

Benefits

- Faster iXBRL creation for HMRC and FCA

- Exceptionally high-quality design-preserving output

- Audit-ready files with complete traceability

- Centralized workflows across tax, financial reporting, and compliance teams